Set up your business in Cambodia

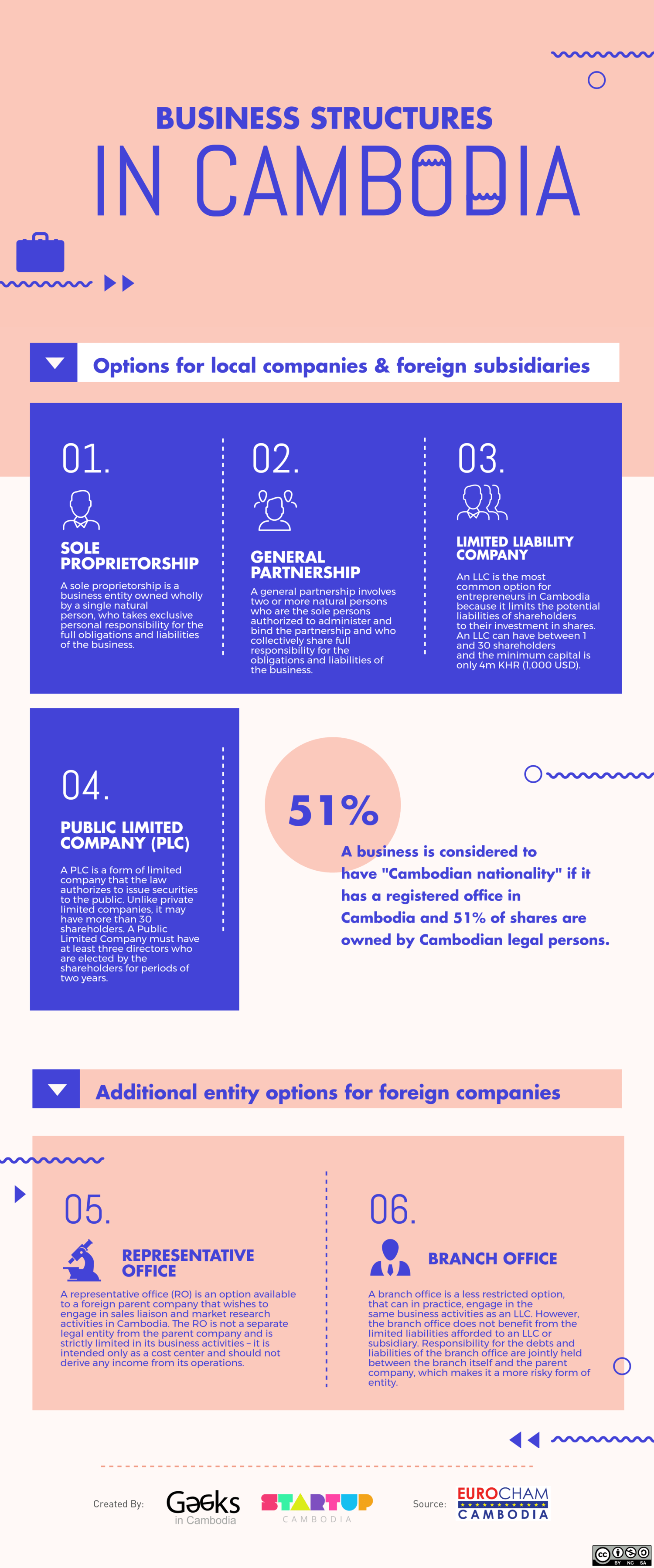

A short guide to doing business in CambodiaWith the right to own 100% of a company as a foreigner, flexible fees and taxes for small businesses, Cambodia is becoming an interesting destination to new businesses, startups, digital nomads and freelancers.

Fall in love with Cambodia and the beautiful city of Siem Reap or the vibrant Phnom Penh?

Seriously considering moving there and setting up your business in the country?

As you are already aware or about to find out, expats often have trouble registering their businesses as they are not familiar with Cambodia’s laws and don’t speak Khmer. We faced those small issues when we first registered our companies a few years ago.

We learned a lot since 2013, thus, thanks to the great network we developed over the years, we are in a position to hook you up with the right persons. They will register your business rapidly and legally while making you avoid doing the common mistakes a new comer often makes!

How much it cost?

As for business registration, there are different packages depending on the size of your company.

For a small sole proprietorship company under the small tax-payers regime is just under $500 USD including the public fees and our service fees.

*You must have a turnover of less than $15,000 per quarter to be considered as a small company.

For medium tax-payers and businesses, it could range from $900 to $1,600.

The reason why it is hard to find accurate numbers is that the tax registration and patent taxes depends on your business activities and can vary. For this reason, most consulting firms and agencies will prefer to talk to you and understand better your situation.

We can also help with the work permit and cambodian visa letters when you do the business registration with us.

We offer this service as well and the fees for the consultation are deductible if you decide to use our services for your registration.

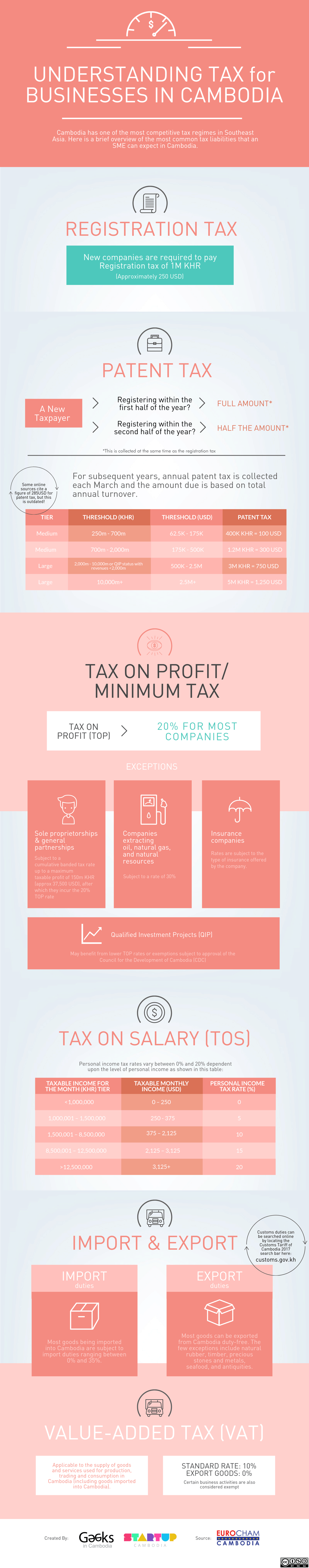

Monthly & Yearly Tax Declaration

From $50 per month.

- Monthly tax return for 12 months

- Year tax return per time per year

- A representative to deal with any tax issues with the tax officials

- Bookkeeping option available

Other Services

- Private or shared office space

- Meeting & Conference rooms

- Virtual Assistant Service

- Receptionist and local phone numbers services

- PO BOX and mail services